FinTech in India: Changing the Game at Subcontinental Scale

India is at an important inflection point. The country recently became the most populous in the world, and its economy is projected to become the world’s third-largest by 2035.

This growth has been spurred by India’s rising middle class and technology adoption at scale. Thanks in large part to transformational, government-aided digitization efforts that have helped the country leapfrog its peers technologically, especially in the domain of financial services – India leads the world in fintech adoption with an 87% penetration rate (compared to the global average of 64%). The country has seen widespread use of mobile-first and QR code payments on Unified Payments Interface (UPI), its public real-time payment rail that enables both peer-to-peer and peer-to-merchant transactions: in 2022, UPI payment volumes topped $1 trillion, or roughly one-third of India’s GDP.

As these drivers continue to pick up speed, India’s fintech market is expected to grow at a 30% compound annual growth rate (CAGR) to reach $200 billion in revenue by 2030. At Citi Ventures, we are excited by the sizeable opportunity this growth represents. As we expand our presence across APAC, we are looking to invest in and partner with best-in-class fintechs in the region that are driving meaningful value creation for both domestic and international markets – such as our current portfolio companies Lentra and Udaan.

Read on for our insights into – and areas of interest in – India’s innovative fintech ecosystem.

What’s Driving India’s Explosive FinTech Growth

Three main factors are powering this rapid change: favorable demographics, widespread technological adoption and innovative government initiatives.

- Demographics: India’s Young Middle Class Comes into Its Own

India is currently experiencing a “demographic dividend,” with 65% of its population under the age of 35. As this cohort reaches middle age, the country’s middle class is expected to grow 144% from 2019 levels to reach nearly 70% by 2030 and almost tripling its buying power – likely fueling a boom in discretionary consumption and setting the stage for continued or even increased fintech adoption.

- Tech Adoption: Smartphones and Household Internet Connect the Nation

India is already the world’s second-largest Internet and smartphone user market. By 2026, the number of Internet-connected households in the country is projected to reach 233 million while the number of smartphone users hits 1 billion – in large part due to companies like Reliance Jio providing affordable 4G and LTE services. As Internet connection increases, we also expect to see more of the population – especially in India’s rural areas – obtain better access to education, healthcare and financial services, both traditional and digital.

- Government Initiatives: India Stack Lays the Groundwork for the FinTech Ecosystem

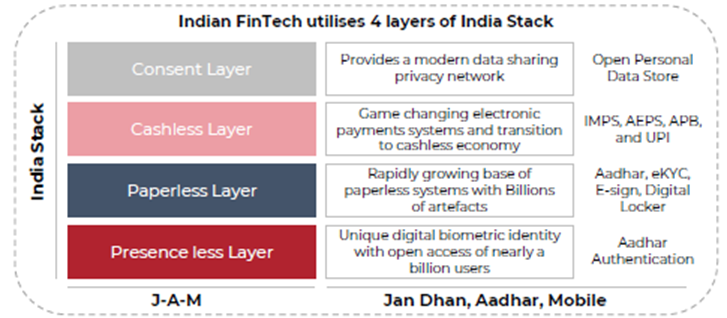

Perhaps the most important driver of India’s fintech ecosystem is India Stack, the government’s sweeping initiative to bring its population into the digital age through the largest set of open APIs and digital services in the world.

India Stack aims to broaden access to financial services through four layers of innovation:

- Digital identity (the “presence-less layer”) - Aadhaar

- Digitization of documents (the “paperless layer”) - DigiLocker

- Real-time payments (the “cashless layer”) - UPI

- Controlled consent of personal data (the “consent layer”) – Sahamati

This makes India Stack a world-class ecosystem enabler: through its open, digital and interoperable layers, it offers seamless service delivery and drives meaningful innovation for both public and private-sector players. We believe that new business models will continue to emerge on the back of new public digital networks underpinned by India Stack, such as the Account Aggregator network (which facilitates data-sharing across platforms) and the Open Credit Enablement Network (OCEN), which digitizes the loan origination process, enabling embedded finance on any digital platform.

Source: Chiratae Ventures-EY FinTech Report: $1Tn India FinTech Opportunity

Key Areas of Interest for Citi Ventures

Given the rapid growth of India’s fintech ecosystem and Citi Ventures’ global remit, we are looking to invest in category-defining Indian fintechs with large addressable market opportunities and disruptive potential, whose products and services may have global applicability. Categories of interest include digital lending, wealthtech, proptech, vertical software-as-a-service (SaaS) and payments, as these align with our investing focus areas and represent sizeable and growing market opportunities.

Digital Lending

India’s digital lending market is expected to reach $514.6 billion in 2030 (up from $38.2 billion in 2021), signaling a tremendous opportunity for direct lenders and enabling SaaS platforms – like our portfolio company Lentra – to help incumbent lenders in India modernize and create digital lending products for enterprise customers.

Lending products and services aimed at micro, small and medium enterprises (MSMEs) – which account for over 97% of all Indian businesses – also play an increasingly important role in the growth of fintech adoption in India. Although many MSMEs have historically been underbanked, market dynamics like the maturation of OCEN (which supports cash flow-led underwriting) and the proliferation of startups like our portfolio company Udaan (which digitizes commerce for SMEs) have greatly increased access to capital for this segment.

More recently, vertical-specific lending businesses like Oxyzo and Jumbotail have built strong customer engagement in emerging segments such as SME financing for manufacturing and agriculture, which will further increase opportunities for disbursements to MSMEs.

WealthTech

India’s wealthtech ecosystem is primed to grow to $10 billion by 2030 at a 31.6% CAGR. As Indians begin to generate more disposable income, we believe that they will look to digital players to help them save and grow their assets. Currently, only 2-3% of Indians invest in the public financial markets, representing a white space of opportunity for digital players to create wealth solutions such as digital advisory investment platforms, trading platforms, personal finance management tools and alternative assets/offshore investment products.

PropTech

The Indian real estate sector offers a significant asset class for retail investment and wealth creation, as the country’s real estate market is projected to reach $1 trillion by 2030 (up from $200 billion in 2021). Although real estate has been among the last sectors to embrace digitization, property technology (proptech) companies in India collected a record amount of private equity investment in 2021. With Indian consumers – both domestically and internationally – demanding fully automated property-buying experiences and the industry digitizing workflows and rooting out inefficiencies, we believe there is significant growth still to come in this market. We are also interested in the space because we believe it represents an opportunity to serve the Indian diaspora with offshore investment solutions.

Payments

The rise of electronic bill payment and the maturation of India’s digital payments infrastructure via UPI have catalyzed a robust digital payments ecosystem in India – an ecosystem that is projected to reach $50 billion in revenue by 2030.

UPI and India Stack exemplify an open instant-payment system model that is a viable alternative to the bank/card model in the U.S. and the closed-platform model in China. Other countries are now launching similar systems, such as Brazil’s bank-to-bank payments platform Pix, which launched in November 2020 and now accounts for 30% of its electronic payments.

With the Reserve Bank of India recently approving the use of credit cards as a source of funds for UPI payments, we expect to see credit card penetration in the country expand from its current 6% penetration rate, further helping move India away from a cash-driven economy. The new mandate could have meaningful second- and third-order effects as well, such as enabling more Indians to buy more goods on credit, which will drive up purchase volumes and spur the growth of the consumption economy.

Despite these steps forward, India’s payment ecosystem remains complex, and high-caliber startups continue to create innovative solutions with global potential on top of and in partnership with the public utilities that India Stack and UPI provide.

Vertical SaaS

India’s SaaS market is expected to drive $35 billion in annual recurring revenue and capture 8% of the global SaaS market over the next five years.

Two primary factors are driving this momentum. First, India’s SME and enterprise solutions market is moving towards a cloud-based environment, increasing product suitability for a global customer base. Second, investor confidence in built-in-India SaaS businesses is rising, resulting in new and sizable cohorts of well-funded SaaS entrepreneurs / startups seeking to disrupt global legacy systems.

We believe that India’s vertical SaaS companies could offer substantial investment upside. Niche software for industry verticals such as healthcare, wellness and logistics can deliver rapid innovation and can create meaningful customer value across their respective value chains. These platforms are also highly relevant to Citi Ventures, as they either serve financial institutions or are natural partners for embedded finance opportunities.

Financing the Future of FinTech in India

In 2009, only 17% of India's population had a bank account. Now, that number is over 80% thanks to the country’s financial inclusion program, Pradhan Mantri Jan Dhan Yojana – however, the majority of Indians are still considered underbanked.

This combination of rapid growth and ‘room for more’ make India’s fintech market a particular area of interest for Citi Ventures. We are eager to invest in and partner with innovative startups across the ecosystem – especially those that are relevant to the U.S. market, cater to cross-border use cases, and/or to whom Citi can provide balance sheet capital – because we believe that such partnerships can provide Citi with visibility into disruptive trends, growth opportunities and strategic insights from market-leading change agents.

If you, your company or anyone in your India network would like to connect with us, please reach out to everett.leonidas@citi.com and/or vibhor.rastogi@citi.com.

To see Citi Ventures’ full portfolio of companies, visit our Portfolio page.