How FinTech Is Bolstering the Creator Economy

Key takeaways

- The creator economy has grown rapidly over the past few years, with independent digital content creators generating up to $250 billion in revenue in 2022.

- Numerous startups have since emerged to support creators and the brands that hire them, from “influencer marketing” platforms to back-office solutions and financial services.

- The creator economy presents a wealth of opportunities for financial institutions, and Citi Ventures is actively looking to invest in the space.

The creator economy — the ecosystem of businesses centered around independent digital content creators (hereafter referred to simply as “creators”) — has seen explosive growth over the past few years. While estimates of its size vary, Goldman Sachs suggested that it hit $250 billion in 2022 and could reach $480 billion by 2027, placing it among the fastest-growing segments of the global economy per Fintechtris.

At Citi Ventures, we believe that the emergence of this thriving new class of solopreneurs (individuals who create and run their own businesses) represents a significant white space for financial services firms, as creators have idiosyncratic financial needs that are currently underserved by the market. With a range of startups leveraging modern technologies, platforms and business models to help creators build and sustain their businesses, the creator economy itself also offers ample investment and partnership opportunities for financial institutions — opportunities that Citi Ventures is actively exploring.

Read on for our insights into, and interest in, the creator economy.

Key Players in the Creator Economy

The creator economy starts, naturally, with creators: artists, bloggers, YouTubers, gamers, social media influencers and more. These individuals (who are primarily millennials and Gen Zers) use their unique voices and niche interests to build loyal fanbases, then monetize the content they publish online via ad placements, brand partnerships, merchandise sales, revenue-sharing from social media platforms, fan subscriptions/donations and other sources. Per the Linktree 2022 Creator Report, the creator economy encompasses over 200 million creators worldwide — 4 million of whom have over 100,000 followers and 2 million of whom have over 1 million followers. The world’s top creator, Jimmy Donaldson (aka MrBeast), has over 300 million followers and earned an estimated $82 million from June 2022-June 2023.

Social media platforms are also key players in the creator economy, as they host creators’ content and often pay them based on the number of views and clicks they drive. Tech giants like YouTube, TikTok and Instagram/Facebook dominate the creator economy landscape today, but tend to take sizable cuts of the revenue creators generate on them. As a result, many creators are shifting toward monetization platforms like Etsy, Patreon, Spotify and Substack, which allow them to connect directly with fans and keep more of the money they earn.

A third set of key players, which is increasingly responsible for the creator economy’s rapid growth, is brands. Brands around the world have seized upon creators as a marketing channel, paying them to advertise their products and services on social media. The global influencer marketing market has more than doubled in size since 2019, reaching an estimated $21 billion in 2023, and is expected to continue to grow as brands shift even more of their marketing budgets toward creators.

The final key player in the creator economy is the creators’ potential audience: the 4.2 billion people worldwide who use social media today.

Startups Supporting the Creator Economy

As the creator economy has grown, a vast network of companies has emerged to help creators build their brands, monetize their followers and manage their businesses.

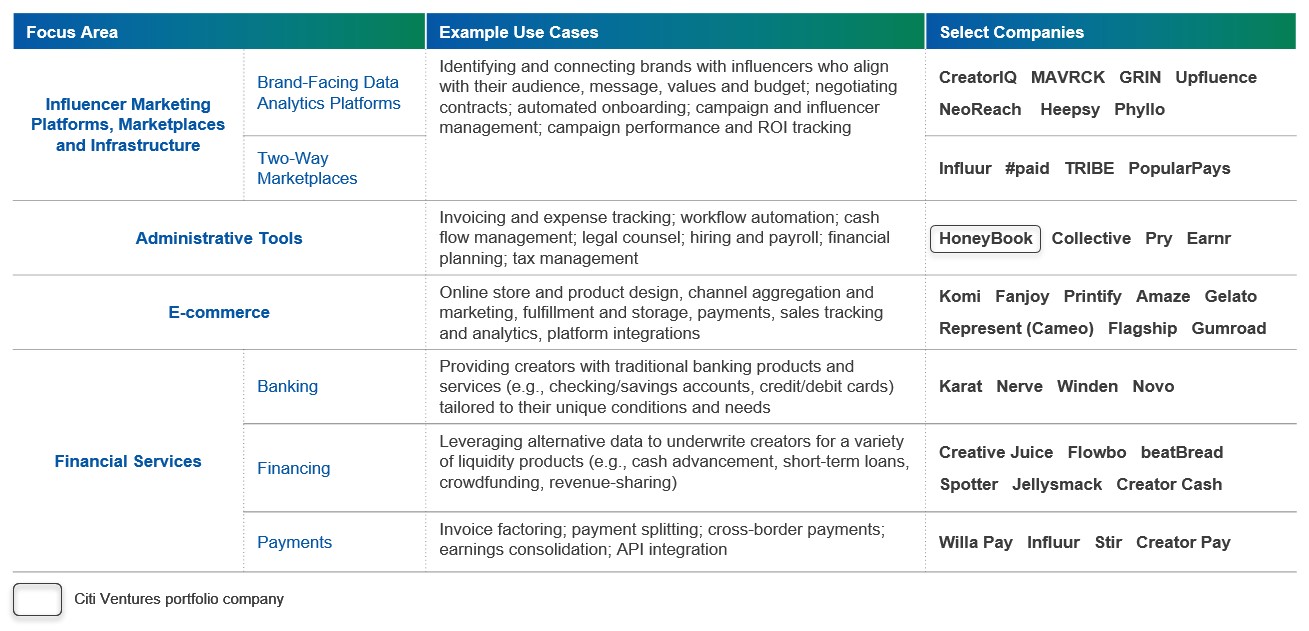

At Citi Ventures, we have been following the space for years, particularly in four areas: influencer marketing platforms, marketplaces and infrastructure; administrative tools; e-commerce; and financial services.

- Influencer Marketing Platforms, Marketplaces and Infrastructure

For the majority of creators, brand partnerships constitute their primary source of income. However, finding and connecting with the right brand partner can be difficult, particularly for creators without large followings or name recognition. Similarly, brands often struggle to identify influencers who align with their target audience, message and values.

Influencer marketing platforms and marketplaces like CreatorIQ and Influur bridge that gap by connecting brands and creators to facilitate content partnerships — helping them negotiate pricing, execute contracts, manage campaigns and track their ROI, leading to more sustainable, effective and impactful partnerships for all involved. More infrastructure-oriented platforms such as Phyllo operate as Open Banking-style networks for the creator economy, aggregating data that other fintechs — and perhaps, one day, traditional financial institutions — can use to engage with creators.

- Administrative Tools

Creators and other types of solopreneurs can struggle to manage the many administrative tasks needed to keep their businesses running smoothly. Several back-office solutions have thus emerged to help them tackle issues ranging from incorporation to bookkeeping, taxes, invoicing and handling collections. For example, Collective helps solopreneurs with S-corporation formation, bookkeeping and taxes, while HoneyBook (a Citi Ventures portfolio company) enables them track inquiries, schedule meetings with clients and prospects, send proposals, sign contracts, automate workflows, send invoices and accept online payments. Additional platforms like Linktree help creators manage their content and make it more discoverable.

- E-commerce

Several startups, including Pietra, Amaze and KOMI, are helping creators generate e-commerce and merchandising sales revenues of their own by designing branded product lines, building online stores and selling via social media (a related trend known as social commerce). The convergence of the creator economy and social commerce is creating new opportunities for creators and brands to collaborate and reach new audiences — opportunities that we believe they will seize upon further in 2024.

- Financial Services

As solopreneurs with varied income streams, creators often have a hard time accessing traditional financial services. Many firms are now arising to embed tailored financial services into creators’ workstreams, from point solutions to end-to-end offerings from companies like Influur.

Point solutions tend to cover three main areas of financial services:

- Payments: Sending invoices and collecting payment in a timely manner is one of the primary pain points for creators, as the traditional process is rife with friction. Most creators have to onboard as vendors with their clients before they can begin work, then have to invoice for work completed and often follow up with clients multiple times in order to get paid. Once remitted, payments can take up to 90 days to process and often come with high transaction fees — cutting into creators’ margins and slowing down the fast-paced industry.

Fintechs in the creator economy are finding unique ways to streamline this process. Willa does so through invoice factoring: it purchases the creator’s invoice, pays it out directly in a matter of seconds and subsequently gets reimbursed by the creator’s client. Influur, meanwhile, onboards itself as a vendor instead of the creator, receives payment from the client up front, then disburses payment to the creator upon completion of the campaign (which is also done on the same platform). Still other fintechs, like Stir, help creators seamlessly split payments and pay each other for content collaborations. - Banking: Creators often struggle to set up business accounts and obtain products like credit cards through traditional banks, as they often don’t qualify due to strict Know Your Business (KYB) requirements. “As a result, many creators use their personal checking account for business expenses. This creates several challenges for creators when filing taxes or applying for a loan,” notes Fintechtris. Creators who are able to set up business accounts often then find that the products and services traditional banks offer don’t fit their particular needs well.

Again, fintechs are stepping in: neobanks such as Nerve are leveraging digital technology to enable creators to open FDIC-insured business accounts in minutes, and are offering them tailored products and services including invoicing and free instant payments. Others, like Karat, are using non-traditional metrics aligned with creators’ income streams — think social media engagement numbers rather than FICO scores — to underwrite them for business credit cards. Karat also offers rewards geared toward creators’ unique needs, from ad spends to personalized merchandise. - Financing: Like any other business, creators need access to capital in order to grow. However, as with payments and banking, traditional financial institutions are poorly positioned to provide that capital, as they lack a deep understanding of creators’ businesses and thus cannot underwrite them.

Several startups are therefore developing new underwriting models to account for the “unconventional” nature of creators’ businesses — i.e., their lack of clear products/services and varied income streams — and extend them financing solutions based on alternative metrics similar to those Karat uses for its credit cards. Creative Juice, for example, offers cash advances as well as 6- to 9-month short-term loans, while Spotter provides YouTubers with large followings (including MrBeast) with cash injections in exchange for a percentage of their ad revenue.

- Payments: Sending invoices and collecting payment in a timely manner is one of the primary pain points for creators, as the traditional process is rife with friction. Most creators have to onboard as vendors with their clients before they can begin work, then have to invoice for work completed and often follow up with clients multiple times in order to get paid. Once remitted, payments can take up to 90 days to process and often come with high transaction fees — cutting into creators’ margins and slowing down the fast-paced industry.

Market Map: Creator Economy Startups

Source: Citi Ventures

Toward a More “Creative” Future of Finance

With approximately 200 million people generating around $100 billion in revenue last year, the creator economy has become a powerful economic force and continues to attract people around the world who view it as a viable full-time career. As the market grows, these “solopreneurs” will represent an increasingly lucrative opportunity for financial services firms that can satisfy their needs.

At Citi Ventures, we believe that incumbent financial institutions can be particularly valuable partners for key players across the creator economy, as incumbents have the breadth and scale required to provide tailored payments, banking and financing solutions to creators, startups and social media platforms alike. We also see a potential untapped opportunity for wealthtech startups and incumbent wealth managers to target creators with tailored offerings. As strategic venture capital investors on behalf of Citi, we are actively exploring ways to facilitate such partnerships, as well as to invest in and engage further with the creator economy. We look forward to supporting its continued growth!

To connect with Citi Ventures, email Luis Valdich at luis.valdich@citi.com, Jelena Zec at jelena.zec@citi.com or Robert Li at robert.li@citi.com.