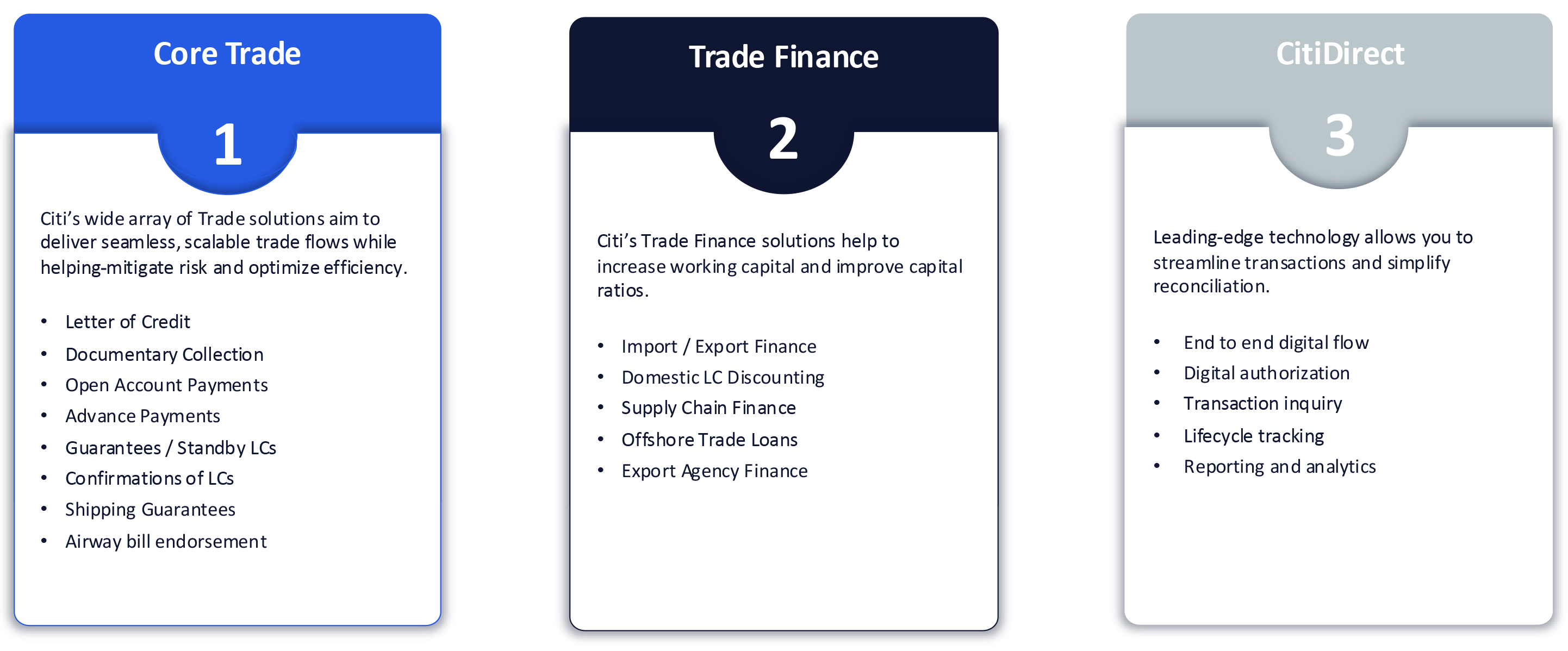

Trade solutions

From digital solutions designed to streamline, optimize, and bring clarity to decision-making, to working capital solutions that strengthen local economies and bring new businesses into global trade, Citi supports the day-to-day operations of clients, while helping them grow their business.