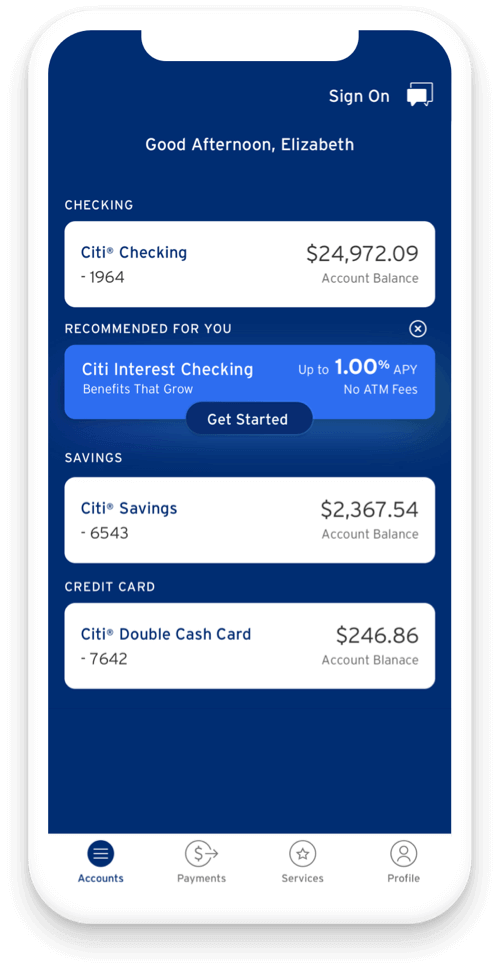

Simplified Banking with Citi®

New to Relationship customers can enjoy Relationship Tier benefits and features when they open a new bank account and keep them if they meet a balance of at least $30,000 within 3 calendar months.1

By selecting Open an Account, you’re choosing an account with everyday benefits. Customers who plan to deposit $30,000+ may be eligible for additional features and benefits by opening a checking or savings account in a Relationship Tier.1

You can also open a CD in a Relationship Tier.

Your Path to Relationship Tiers

Open, combine and link to meet minimum balance requirements.

Grow Your Citi Relationship

No matter where you start, you’ll automatically move up and enjoy more benefits once your balance grows to the next Relationship Tier.1

To remain in your Relationship Tier, you need to make sure your Combined Average Monthly Balance doesn’t drop below your Relationship Tier’s minimum Balance Range for 3 consecutive calendar months.1

Citibank Account FAQs

We have the answers for your banking questions.

Smart Ways to Manage Your Money

When it comes to your finances, knowledge is power. Stay on top of managing your money and savings with financial education resources that can help you achieve your goals.