Why PropTech Is Poised for a Comeback

While venture capital funding to U.S.-based proptechs in Q2 2023 was down 70% YoY and 80% since its peak in Q4 2021 (per CB Insights/Pitchbook), we believe that the sector might be turning a corner, entering an exceptional time to invest in emerging proptechs.

Following in FinTech’s Footsteps

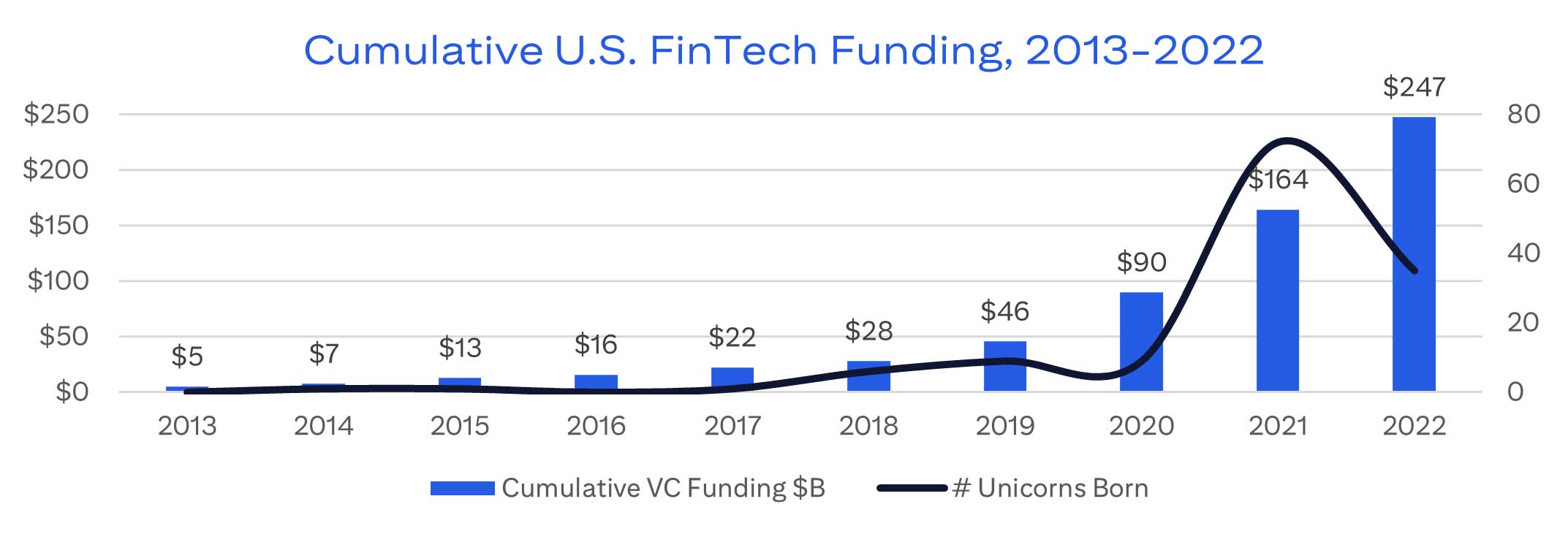

Since Citi Ventures’ founding in 2010, we have had a front-row seat as fintech has evolved into one of the most important sectors for VC investing. As the graph below shows, VC firms have poured almost $250 billion into the U.S. fintech ecosystem since 2013 — leading to the creation of over 130 unicorns (19 of which are Citi Ventures portfolio companies), prompting lasting change in the industry and providing real benefits to consumers. Even so, our view is that the fintech revolution is still in its early stages, with much more value yet to be created.

Data: CB Insights, Pitchbook; Citi Ventures analysis

The real estate industry, by comparison, constitutes a larger portion of the U.S. GDP than the finance and insurance category, at 12.5% vs. 7.6% as of Q1 2023 (per Federal Reserve Economic Data [FRED]). Yet over the same period, proptechs have received less than one-fifth as much VC funding as fintechs, leading to the creation of less than one-fifth as many unicorns. Is it possible, then, that proptech is just a few years behind fintech?

![Graph showing cumulative U.S. PropTech funding, 2016-[2025]](/ventures/images/article/20230818_PropTech-Funding-Graph-vF.jpg)

Data: CB Insights, Pitchbook; Citi Ventures analysis

The primary difference in the above charts comparing fintech and proptech is the year in which they begin. Of course, we cannot expect 2023-2024 in proptech to look like 2021-2022 in fintech — we may not see another year like 2021 in our lifetimes. Yet there are reasons to believe that proptech has the potential to create at least as much long-term value over time as fintech continues to create.

Why did fintech come first?

It is impossible to say for certain, but we see several potential reasons why proptech has lagged behind fintech. The Global Financial Crisis of 2008-2009 (GFC) was undoubtedly a catalyst for innovation; financial services incumbents generally have larger IT budgets than real estate incumbents; and many transactions addressed by fintechs occur with greater frequency and less complexity than, for example, the purchase of a home. Furthermore, many VCs come from financial services backgrounds and understand the financial ecosystem better than that of real estate.

Real estate is also by its nature a more conservative industry than financial services, with more conservative incentives for its participants. Often, multiple parties exert some level of control over a single real estate asset. Timelines to measurable outcomes are inherently long, with limited flexibility along the way to make dramatic changes to the original plan. In addition, real estate incumbents have generally enjoyed strong and increasing profits since the GFC. Within the industry, therefore, the adage “if it ain’t broke, don’t fix it” can be applied to everything from a toilet in a multifamily housing unit to a property management software solution.

Why is proptech next?

The last three years may have provided catalysts for change in the proptech space:

- Covid-19 shook the world in 2020. The pandemic not only drove large-scale digital transformation across many industries, but also fundamentally changed the way people think about where they live and work, deeply impacting all real estate asset classes. Millennials and Gen-Zers were already increasingly delaying marriage, family formation and homebuying. Now, the age of hybrid/remote work has arrived and everything from offices to vacation homes needs reinvention.

- IPOs exploded in 2021. The second pandemic year saw a surge in sizeable outcomes for proptechs, with 12 companies joining Airbnb ($90 billion market cap), Zillow ($13 billion) and a handful of others in the public markets. While the public markets have been kinder to some of these new entrants than others, participants in the space can now point to several examples of how big proptechs can become, as real estate incumbents become more open to engaging with startups.

- Interest rates rose in 2022 The Fed’s assault on inflation caused a dramatic drop in homebuying activity and revealed sizable cracks in the commercial real estate (CRE) industry. This instability has continued well into 2023, with would-be homebuyers on the sidelines due to high prices, high borrowing rates and low housing supply, and sellers unwilling to give up their historically low rates from a few years prior. Many observers are waiting for the next shoe to drop in CRE, as portfolios lose value, long-term leases expire and loans need to be refinanced at higher rates.

These developments (sometimes counterintuitively) make us optimistic for a few reasons:

- We believe that the large-scale adoption of technology across the real estate industry is inevitable. Though real estate has generally been one of the slowest industries to adopt technology, the question is “when,” not “if.” Crises like the pandemic can be catalysts for change, making incumbents vulnerable and increasing the importance of the modernization and efficiency gains that proptechs can deliver.

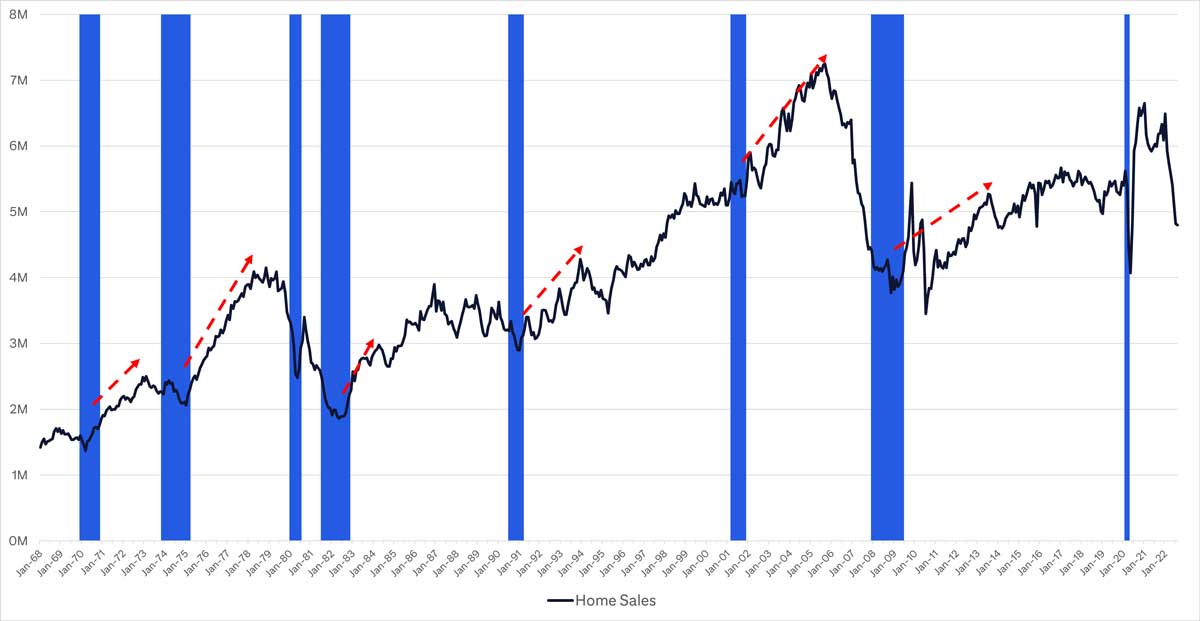

- The long view still looks good. As long-term, multi-cycle investors, we are not in the business of “calling the bottom.” We do, however, believe that the future of proptech looks brighter than the present. For example, countless proptechs are either directly or indirectly dependent upon homebuying activity for revenue, and we plan to be in the market when homebuying activity inevitably recovers. Whether we settle into a “new normal” or see capital from the sidelines start to pour into the sector at an accelerated pace, the table is set for the next few years to be better than the last few quarters.

- PropTechs are being tested. Real estate is an inherently cyclical industry, and we believe the market is currently experiencing a cyclical pullback, not a secular one. In the process, it is learning which business models were only viable in ideal conditions and which are truly necessary and resilient. The latter may present excellent investment opportunities in the coming quarters amid reduced investor competition, lower valuations, reduced competition for talent and increasing focus on unit economics. Cyclicality is a fact of the industry, but the secular tailwinds may be picking up.

Data: National Association of Realtors (home sales), FRED (recessions); Citi Ventures analysis

Citi Ventures: A Unique PropTech Partner

As the world’s most global bank, Citi understands that real estate is the world’s most significant store of wealth: more valuable than all global equities and debt securities combined, at over $300 trillion. Citi is also a major player in the real estate and proptech space:

- The bank has over 100 million customers, many of whom turn to Citi for everything from mortgages to investment advice – which often includes real estate investing.

- Citi’s Real Estate Technology investment banking franchise provides tailored solutions to proptechs with access to some of the largest institutional owner/operators in the space.

- Citi works with owners, operators and investors in all asset classes of real estate across several other business lines, including:

- Residential Real Estate, which provides:

- Residential financing to mortgage originators, operators, real estate investment trusts (REITs) and private equity counterparties across the full breadth of the residential sector, including property companies (propcos).

- Liquidity solutions for clients across agency-eligible residential whole loans, mortgage servicing rights, non-agency whole loans and single-family properties.

- Connectivity across the residential sector for whole loan trading, securitization, advisory, capital raising, treasury and trust services, investment banking and equity/debt capital markets.

- Commercial Real Estate, which provides:

- Financing for CRE properties located throughout the U.S. across a variety of borrowers, including individual real estate investors, institutional sponsors, REITs and owner-occupant companies.

- Conduit securitization financing secured by senior mortgages on cash-flowing assets across apartment, industrial, retail, hospitality, office, self-storage and niche property types.

- Commercial mortgage-backed securities (CMBS). Citi is among the largest lenders by contribution into CMBS issuance.

- Residential Real Estate, which provides:

Thanks to our deep connectivity to these businesses and many others at Citi, Citi Ventures is uniquely qualified to be a valuable partner to emerging proptech companies. Our current proptech portfolio includes HomeLight, Loft, Roofstock, Unison and a TBA short-term rental hospitality manager.

We want to invest in and partner with exceptional entrepreneurs with differentiated, technology-driven approaches to the world’s largest asset class. If you fit this description, we’d love to connect.