The Ownership Economy: Empowering Creators Through Crypto

Suppose you are a talented musician, a gifted artist, or just someone with a knack for being funny on camera. Thanks to the ubiquity and scale of today’s Internet, it has never been easier for you to connect with a worldwide audience of people eager to consume your creative output.

But owning and profiting from your work is a different story. The “creator economy”—the online economy in which individuals create and monetize various forms of content—is estimated to encompass more than 50 million creators and drive annual revenues of more than $100 billion. Currently, however, it is dominated by a handful of Internet giants (e.g., Meta, TikTok, and Google) that control and curate the content, limiting creator rights and ownership.

To correct for this power imbalance, a new type of creator economy is

emerging—one that leverages

cryptocurrencies

and blockchain technology to put power back in the hands of the creators

themselves. Called the

“ownership economy,” it could help expand artistic freedom and improve

compensation for creators while empowering new ways for stakeholders to invest

in and consume their favorite content.

The Web2-Based Creator Economy of Today

The creator economy has been around since the earliest days of the commercial Internet. It first manifested through the individual, static web pages of the “Web1” era, and later through the blogs and forums that helped launch the “Web2” era that continues today.

Though these initial offerings drove an increasing number of people to create and post original content online, they didn’t foster much of an economy. That changed as Web2 matured into its current form. Centralized social media platforms such as Facebook, Instagram, and YouTube published new, better tools to help users produce, market, discover, and distribute content. This coincided with the rise of “influencers,” digital-native celebrities who were able to monetize their fame and the attention they could command through advertising and brand sponsorships.

While some influencers have

become very wealthy, thus far the platforms themselves have captured most of the revenue

generated within the creator economy. YouTube, for example,

pays its creators

around $0.00154 per video stream, while most musicians on Spotify earn less

than $3,500 per one million streams. Many people thus believe that

too much power has been concentrated in these platforms, whose economic interests often are poorly aligned with those of the

creators that drive them.

The Web3-Based Ownership Economy of Tomorrow

Web3, the next iteration of the Internet, could disrupt these dynamics by

ushering in a more user-driven “ownership economy.”

The ownership economy is an emerging form of the creator economy in which the

content platforms are built, operated, funded, and owned by the users rather

than by tech firms. This structure allows creators to bypass the walled

gardens of rent-seeking intermediaries and directly interact with and monetize

their audiences.

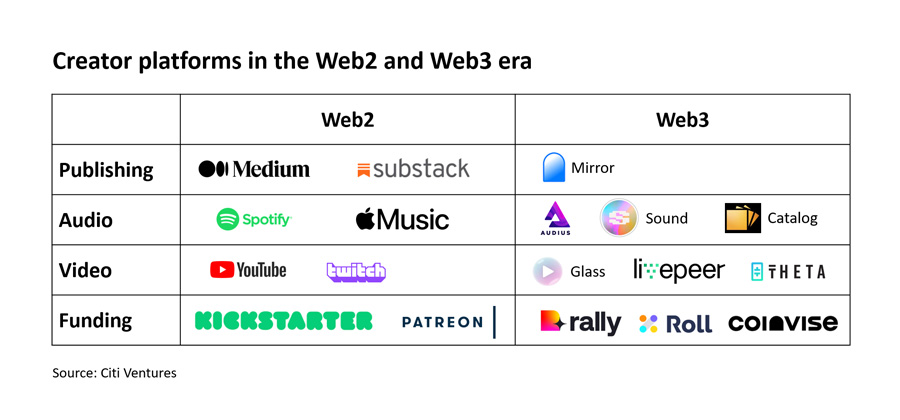

Several examples of this already exist. Audius, a decentralized music streaming platform similar to Spotify, uses a token called AUDIO to reward artists, fans, and developers who publish popular songs, create playlists, or build apps on the platform. Token holders can use the AUDIO token to unlock premium features, participate in the governance of the Audius platform, or sell them to someone else. Glass provides a similar alternative to YouTube for video, and Mirror does the same for publishing, allowing writers to split revenue with other contributors and embed features such crowdfunding on their blogs.

Crypto tokens are key to the ownership economy, as they both carry value and can be programmed to provide token holders with certain rights and privileges. Besides tokens tied to content platforms, other types of tokens used in the ownership economy are:

-

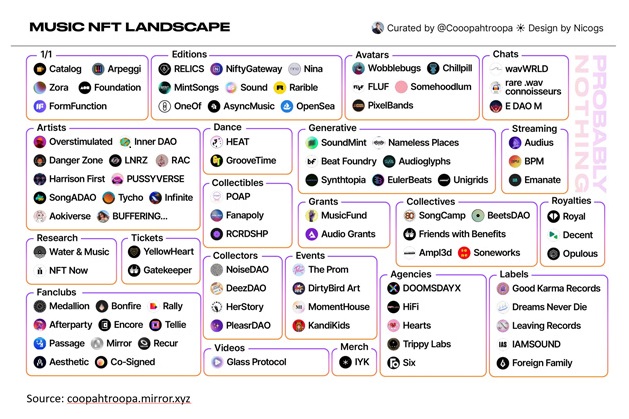

Non-fungible tokens (NFTs). NFTs can unlock new economic models for creators, enabling

more granular price tiering

than today’s ad-based models, which generate revenue uniformly regardless of

how enthusiastic fans are about a particular creator’s content. The rise of

NFTs is already disrupting several sectors, including the

music industry—artists who sell their music as NFTs on the music platform

Catalog, for example, can

earn up to 7.5 times more from doing so

than they can by streaming their music on Spotify for a year.

-

Social tokens.

Tied to a person or community, social tokens can help artists build more

direct relationships with their fans by offering them access to discounts,

merchandise, and even the right to receive financial rewards for backing

creators. Note that social tokens can be fungible or non-fungible. Platforms

like

Rally

make it relatively easy to launch social tokens, and numerous artists,

musicians, athletes, and other celebrities are introducing them to their

fans. In 2020, Grammy Award-winning artist and producer RAC

launched a social token

that gives fans access to private discussions, exclusive content, and

merchandise.

Social tokens can also be tied to sports communities as a way of “gamifying” the fan experience. Professional soccer clubs including Paris Saint-Germain FC and FC Barcelona have issued tokens that give fans the chance to win merchandise, interact with the team, or vote on proposals like what music will be played during matches.

Finally, blockchain technology is enabling the creation of Decentralized Autonomous Organizations (DAOs), online communities with a common goal or passion that are governed from the bottom up. DAOs take many different forms and serve many different purposes; within the ownership economy, they could provide another means for creators to directly connect with audiences. DAOs could even allow artists to co-create content with their fans and compensate them for their contributions—evolving an individualized creator economy into a communal one.

Source: coopahtroopa.mirror.xyz

GFinancial Services and the Creator Economy

The creator economy today is sizable and will likely grow further. While platforms such as Facebook and TikTok almost certainly will continue to play an important role due to their worldwide reach, the rise of the ownership economy will give artists and their communities another way to connect, create, and profit.

This will present many opportunities for financial services firms, and as the ownership economy takes root it will be important to understand and capitalize on the new business models that will emerge. For example, banks currently provide capital to creators; in the future, it may be possible for those creators to obtain loans by putting up their NFTs as collateral. Banks could provide other important services to them as well, such as custody solutions that allow both creators and their communities to store their digital assets in a secure and convenient manner.

The decentralized future looks bright for content creators, and the financial institutions that support them in sharing and monetizing their work will have much to gain from it as well.

For more of Citi Ventures’ thought leadership on blockchain, digital assets, and the Metaverse, click here.