Tokenize Everything: NFTs and Digital Asset Management

Non-fungible tokens (NFTs) are all the rage these days. In our first article on NFTs we discussed their meteoric rise, initial use cases, and possible future. In this article we drill down into how this exciting new technology could impact the asset management industry.

A Market Set for Exponential Growth

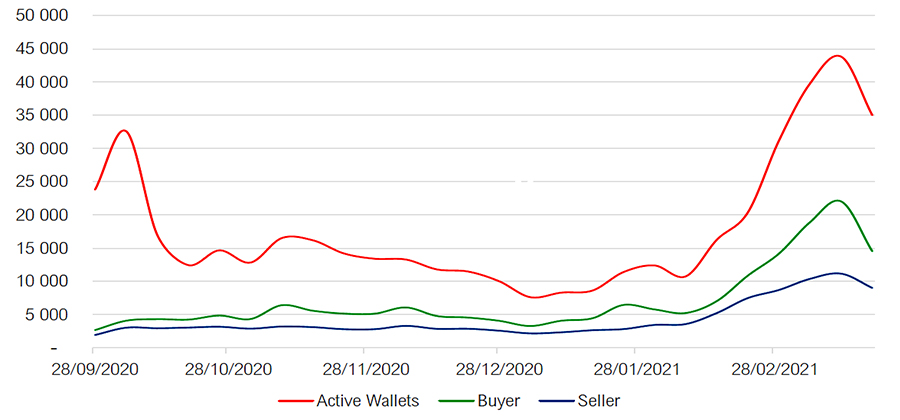

The market cap for NFTs hit $430MM at the end of end of March 2021, having grown 1,785% since the beginning of the year. The bubble burst only a few weeks later, with the average NFT price dropping nearly 70% from its peak. This boom and bust is similar to the one that cryptocurrencies saw in 2017, and can similarly be seen as the growing pains of a disruptive new technology, exacerbated by the COVID-19 pandemic.

Though the NFT market is still relatively small, much of its value has been created in the last six months. Since NFTs can be used to digitize nearly every kind of asset, they could easily become a billion-dollar opportunity for the asset management industry within the next decade. As the NFT ecosystem continues to grow, we believe that asset managers and custodians should watch emerging trends and seek to capitalize on this fast-growing market.

NFT Trends to Watch

The emergence of NFTs and growth of the broader crypto market have accelerated several key trends, including:

Meme Investing

The COVID-19 pandemic dramatically increased the activity of retail investors in secondary markets, who brought with them a new investment “strategy”: the meme stock. The much-discussed recent short squeeze of a video game retailer’s stock made it clear that these investors are not always driven by traditional market indicators, but instead follow social trends and even tweets. This phenomenon has massively benefitted cryptocurrencies, with a Shiba Inu-themed crypto recently reaching a multi-billion-dollar market cap.

NFTs have not been spared from this rush of interest, as many early buyers of NFTs were retail investors. As the market matures and institutional investors begin investigating the space more seriously, meme investing should be considered alongside traditional indicators —particularly for growing and primarily retail-driven markets like gaming.

Smart Contracts and Next-Generation Custodianship

Smart Contracts are bits of code that can automate simple tasks and instructions on a blockchain. They will likely become key to managing NFT assets in the future, as they can streamline middle- and back-office responsibilities usually performed by custodians.

As these operational duties become less time-consuming, the custodian’s role may shift to other stages of the NFT asset lifecycle. For example, their expertise in regional and local regulatory landscapes and cross-market transactions could support the issuance phase of NFTs, ensuring that the smart contracts integrate all the necessary instructions. Custodians could also help monitor changes relevant to NFTs and assist in reissuing them accordingly. Finally, guaranteeing data integrity and availability could become a core value proposition for custodians, as it would provide a competitive advantage to assets in a highly liquid market.

Fractional Ownership and Decentralized Autonomous Organizations

Fractional ownership breaks assets down into shares that give certain rights to the owners. It is already popular for assets such as real estate, but given its high overhead fees has thus far been adopted mostly for high-value assets. Tokenizing assets as NFTs makes the process much easieropening fractional ownership up to assets of any type and value.

However, fractional NFTs can be leveraged on their own only for relatively simple assets with few or no governance requirements, such as most collectibles. When considering more complex assets like houses, fractional ownership agreements must consider challenging concepts such as the terms of consensus—e.g., what happens when the co-owned asset is sold.

Here, another blockchain innovation can help: the Decentralized Autonomous Organization (DAO). DAOs are digital organizations that automate governance through algorithms—while human co-owners allocate assets into a DAO and make major decisions through integrated voting mechanisms, the DAO itself can handle most of the operational or administrative work. Asset managers can leverage DAOs to manage any kind of bundled assets, with decision-making and voting rights controlled through blockchain tokens.

Decentralized Finance

Decentralized Finance (DeFi) is the umbrella term for much of the financial innovation occurring on blockchains. By tokenizing their assets and opening them up to the DeFi market, asset managers can gain access to some of the revolutionary ideas in the space—such as lending on Decentralized Lending Pools, passive income strategies including staking and yield farming, and trading through Automated Market Makers.

Digitizing ownership of their assets could help asset managers see lower costs, better client

experience, and a significant increase in liquidity and revenue. DeFi alone could help commoditize a whole new

universe of assets, and he broad range of what NFTs can represent could help expand and diversify

portfolios from assets previously reserved for the wealthy to others that would never have been

considered before.

Barriers to Adoption of NFTs

While the NFT market offers clear upside for asset managers, several barriers to adoption remain, including:

Legal Challenges

Crypto-related laws are developing

quickly around the world, and many of them will apply to NFTs. However, it will take time to

understand the implications of NFTs within industries with unique legislative frameworks, such as

property deeds or copyright. While tokenizing physical assets with pre-existing legal systems should

be relatively simple, virtual assets created on blockchains currently lack ownership verification

and enforcement ecosystems. Until those are created, NFTs will remain a

breeding ground for intellectual theft.

Regulatory Implications

Regulatory experts are debating whether NFTs should be considered securities and regulated as such. Currently, the simplest way to determine this is to apply the Howey Test to see if an NFT constitutes an "investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others”. By this logic, collectible-like NFTs should avoid qualifying as securities, but NFTs that are designed to produce some form of return might draw regulatory oversight. However, DeFi innovations like staking—which could allow even a simple collectible NFT to generate financial returns—could complicate this distinction.

While some might consider this lack of clarity a risk factor, it could provide an opportunity for asset managers and more to explore NFT technology and impact the direction legislation and regulation will take. Ultimately, a more concrete regulatory system for NFTs should help stabilize the highly volatile market as well.

Costs

Issuing or transacting NFTs can currently carry significant financial and environmental costs. Fees can vary from a few cents to hundreds of dollars, and are mainly due to the widespread use of a particular public blockchain. This is also the reason for NFTs’ significant carbon footprint: the algorithms used on this blockchain are extremely energy-intensive. Widespread adoption of third-generation blockchains should help eliminate both these costs.

The Future of NFTs and Asset Management

As a novel asset class, NFTs are not yet being leveraged for many use cases beyond virtual art and collectibles. However, they should soon see much further growth from assets with broader utility. Virtual real estate sold as NFTs has already reached sky-high prices and is being rented out to artists and marketers keen to access a crypto-rich audience. A famous rock band also recently issued NFT-based golden tickets, which give access to all their future concerts as well as other benefits comparable to an exclusive fan club membership.

NFTs’ broadest potential has yet to fully be understood, as the most revolutionary ideas are just starting to appear. For example, mobile gamers around the world can earn crypto by playing video games and even rent out their in-game assets to other gamers. In addition, personal browsing information—currently being leveraged by most of the internet for free—can be tokenized into NFTs, fractionalized, and sold off based on owner preference and financial yield. Finally, autonomous AI agents like those being developed for self-driving cars could eventually make use of public NFT asset networks to automate or schedule access to shared resources such as road infrastructure

For asset managers and custodians, the best way to understand how NFTs can be leveraged is to get involved early with the many startups popping up in the space. The scale of NFTs’ future market impact is difficult to gauge right now, but given the current rate of innovation it could create a generational shift never before seen in the industry. If that happens, these startups will need help navigating this shift—meaning that now is the best time for the asset management industry to adopt these new concepts and help determine the future leaders in the asset management industry.

Thanks to our extensive work in the blockchain realm and core presence in the global financial industry, Citi is the perfect partner with whom to explore the NFT space. Please reach out to our team if you have any questions or would like to learn more.

For more information, contact Victor Dmdb at victor.dmdb@citi.com or Victor Alexiev at victor.alexiev@citi.com.

Chirdeep Singh, Markets Entrepreneur-in-Residence, ICG D10X, contributed to this article.

For more on DLT, digital assets, and the metaverse, click here.