Innovating for Growth in an Era of Change

Adapted from an article published in the Journal of Financial Transformation on January 6, 2021

We live in disruptive times, with businesses facing growth challenges rooted in digital transformation, a global pandemic, and ongoing shifts in our society and economy. To grow, even companies with proven business models and large customer bases need to innovate.

Traditionally, that has meant choosing between two approaches, improving existing products and services or undertaking bolder, riskier efforts that often lie outside of core businesses and markets.

The first strategy is a tried-and-true method of incremental growth, but may not provide the spark needed to address new challenges and opportunities. The second offers more potential for dynamic growth, but carries more risk and can be a distraction, reducing the effectiveness of existing operations.

Rather than choose between these two approaches, firms can remain a step ahead of deep disruption by viewing each as a way of responding to a particular kind of change—and by organizing their operations to tackle both.

Growth and Types of Change

All companies must deal with two fundamental types of change: product change and product-market fit change.

To understand the difference, let’s ask: “What makes a successful business successful?” There is no single answer, of course—every thriving firm has a unique story. Yet, businesses that stay in business tend to have three things in common. First, they have identified a problem that a group of customers needs to solve, also known as a “job to be done.” Second, they have developed a product that helps solve the problem or do the job in question, and third, they have marketed that product to customers who need it.

Consider banks as an example. People need a way to safely store and access money. Banks provide both, and market their services to people by running advertisements, opening branches, etc. As long as the fundamental customer problem that banking solves remains constant, banks will remain in business. As a result, banks can often achieve continuous growth by improving the client experience and how they deliver on the job they do for customers—that is, through product change.

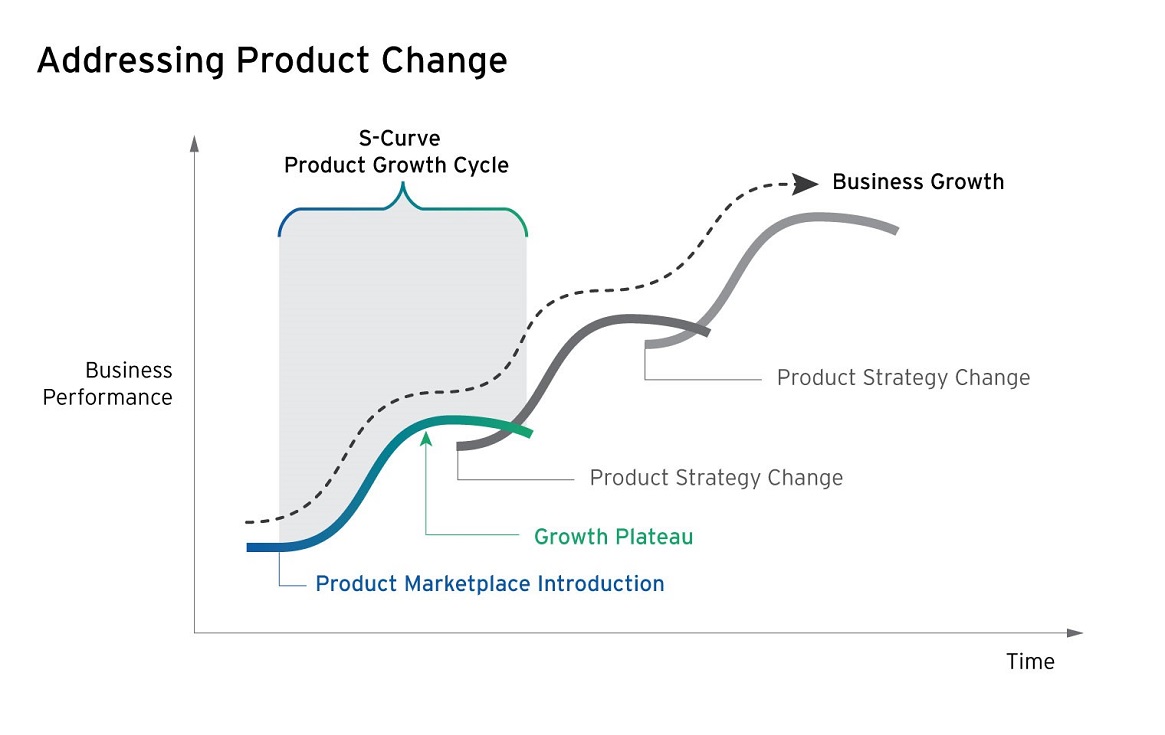

Product Change

Product change occurs when competition between companies or the emergence of new technologies gives rise to the proverbial “better mousetrap”―innovations that enhance existing solutions in order to offer lower prices, superior experiences, or greater convenience.

For most companies, product change represents a familiar competitive threat and calls for relatively minor, product-specific innovations that rarely explore the underlying job to be done. While this type of investment can help companies keep up with standard market shifts, it is insufficient for dealing with the more significant type of change: product-market fit change.

Product-Market Fit Change

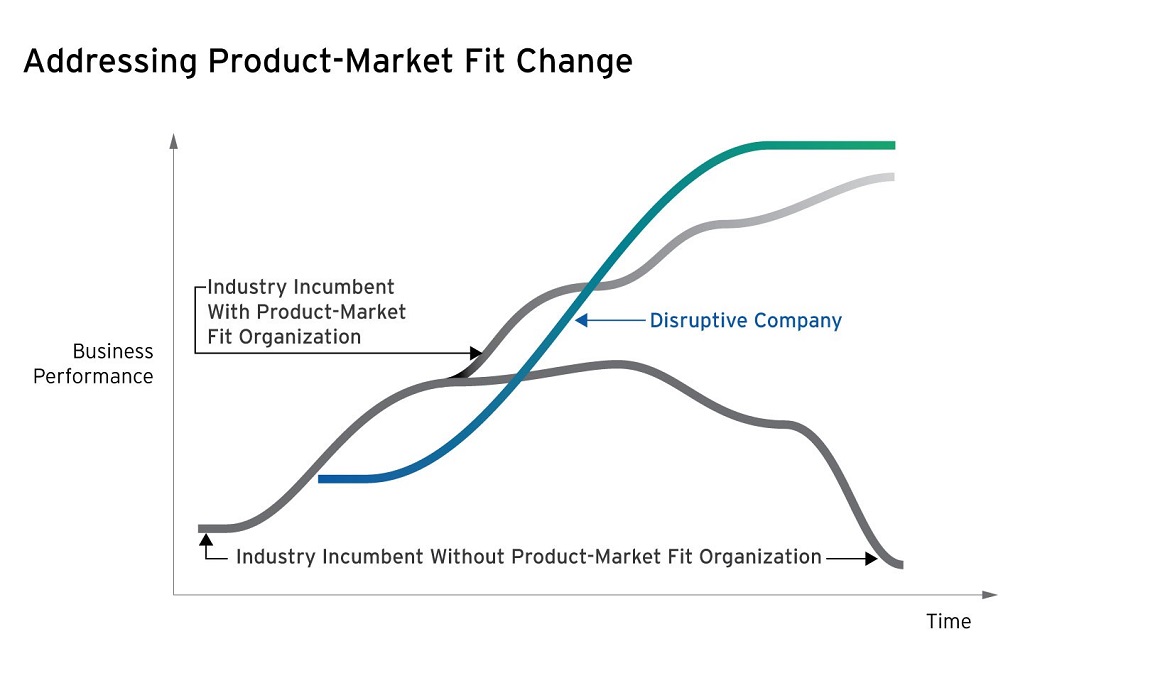

Product-market fit change occurs when profound shifts in technology, society, or customer behavior alter or sever the connection between a business’s core solution and the problem that solution seeks to solve.

Consider compact discs (CDs). In the late 1990s, several major consumer electronics and music industry companies fought over the next generation of CDs. Each side assumed that the job to be done for the music industry (selling albums to individual consumers) remained the same, and hoped to capture a growing market through their next-generation discs. Those hopes were dashed by the rapid emergence of MP3s, which leveraged new technology and changing consumer behavior to reshape the job of a song, rendering CDs ill-fit for the market and CD-makers far behind the times.

For most firms, product-market fit change is unfamiliar. Though it represents an existential threat. Many companies, particularly large, established ones, are not structured to recognize and respond to it.

Faced with such change, companies need to interrogate their “first principles”, or the problems and solutions that make their business possible and establish their original S-curve growth. This means asking basic questions like, “What is my product all about,” “What job is it doing for customers,” and “What jobs do customers need to be done?"

Organizing for Innovation and Growth

Organizing a company to address both types of change requires thoughtful planning and an open mind. In many ways, it requires firms to build two enterprises that operate differently―with people, processes, technology, and risk structures appropriate to each.

A product change organization assumes that the core problems and solutions underlying the business are unchanging and well understood. Staffed by execution-oriented employees, it works relentlessly to drive efficiencies, improve the customer experience, explore new distribution and delivery channels, and increase customer satisfaction around existing solutions. It uses standard business metrics to measure its success. Its risk structure is typically conservative, favoring decisions and projects that fit existing financial models and have the best chance of yielding immediate ROI.

A product-market fit change organization by contrast, assumes that fundamental disruptions to the core business are inevitable and imminent. Staffed by people who are obsessed with understanding root-cause customer problems and the unique needs of niche market segments, the organization constantly seeks new concepts to explore and new capabilities to invest in. It uses metrics that are unusual and expansive, and is more willing to accommodate projects and investments that carry higher risk and promise longer-term rewards.

Mastering Product-Market Fit Change

Mature businesses that have grown by mastering product change should still invest in product-market fit change, because both strategies are needed during significant, large-scale disruption. Incorporating the following three key principles can help:

- Learn in market: The best way to validate a value proposition is simply to put it in market, see how customers react, make changes, and continue testing until you truly understand their problems, goals, and pain points.

- Expand and change your measurements of success: Successful innovation often requires significant transformation, but there is little incentive for businesses to remake themselves without seeing a clear need in the numbers. However, those numbers likely will not be found in familiar places. To capitalize on product-market fit change, companies may need to imagine profit and loss statements that do not yet exist, come up with customer satisfaction measures that are not yet used, and focus on the kinds of leading indicators that inspire new product design rather than on lagging indicators around marketing campaign performance.

- Measure, evaluate, and manage investments differently: While large returns are always good, venture capital investments can and should pay off beyond the bottom line by helping organizations learn how to identify emerging opportunities and measure, evaluate, and manage new types of investments. In turn, these learnings can be applied to internal investment in innovation that produces new and organic growth.

From Luxury to Necessity

Innovating for growth is not a luxury anymore—as societal, economic, and technological shifts roil all businesses, it has become a necessity.

In turn, understanding the differences between product change and product-market fit change is crucial. So is organizing and building products and services around those types of change. The leading firms of tomorrow will do both—knowing that while the challenge is great, so is the opportunity.

For more on innovation amid disruption, click here.